新湖畔网 (随信APP) | 专栏文章:私有化和放松管制-两种导致高价滑稽失败的做法

新湖畔网 (随信APP) | 专栏文章:私有化和放松管制-两种导致高价滑稽失败的做法

【微信/公众号/视频号/抖音/小红书/快手/bilibili/微博/知乎/今日头条同步报道】

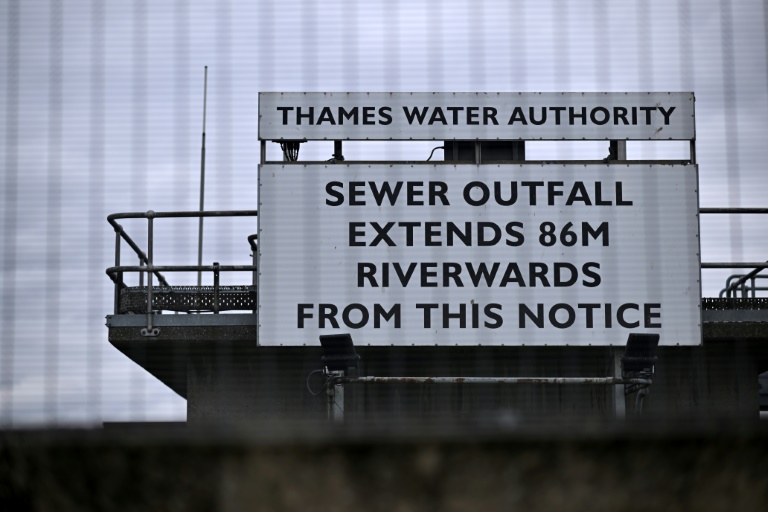

英国私有化的水务公司一直在向河流和海滩排放生活污水 - 版权AFP Ed JONES

有人说,“让政府像经营企业一样”。智者们回答说,“呃...好的”,于是这个管理混乱的世界就诞生了。

这句话实际上意味着“让一些本不可能、不应该、也不能像企业一样经营的东西像企业一样经营”,但那时已经太迟了。特别是西方世界对这两根干枯的坏主意玩得风生水起。

私有化的理论是可以为政府省钱并减少官僚主义。但事实并非如此。私有化的整个概念荒谬可笑,而且还可以证明。

每周任何一天只需在新闻中搜索一下私有化就知道了。许多巨额收入被移交给私营部门,然后只在虚拟枪口下或干脆不缴税。

这就好像把你的工作和一辈子的积蓄送人,并拿到一张玛格丽特·撒切尔或罗纳德·里根的纸板剪影作为补偿。如果你觉得满足,那么你和你的教育都存在严重问题。

为了让大家更好地理解私有化的运作方式,这里有一个来自我祖国澳大利亚的故事。有个数字在澳大利亚流传,称自从上世纪90年代以来,澳大利亚由于私有化节省了1千亿美元。我不会链接这个看起来过于完美的数字,因为我不相信它。

当你意识到我们每年的国内生产总值超过1.5万亿美元时,这个神秘数字的真实价值就更容易理解了。所以在30多年时间里,我们节省的相当于几周的国内生产总值。在这30年的同样时间里,一切变得更加昂贵。

我们给私营部门以及基础设施、能源等领域送出巨额金额的商业好机会。这些服务曾相对便宜。这种“竞争”只带来了非常相似的价格和商业模式。

我们用几代人的纳税金建设和支付的公共服务如今要么更加昂贵,要么已经不存在了。你曾纳税以换取服务。如今你纳税了,要么得不到任何回报,要么如果 lucky 的话偶尔才能看到服务。资金不足是普遍存在的。

另一方面是放开监管。监管只是规则。理念是每个人都要遵守同样的规则。大多数人都这样做,如果有人不这样做,通常都会引起愤慨。挺简单吧。

同样的愚蠢逻辑也适用。“减少官僚主义”意味着现在你需要通过法庭案件来制止人们违法。他们只需支付罚款并继续违法,而不是被关闭直至他们变得合规。

这种荒诞行为的副产品包括猖獗的欺诈和腐败。价格不再受控制。贫困普遍存在。基本生活成本不断受到涨价的威胁。由于制度基本上不对任何事情负责,所以贫困增加。

大多数企业界也深陷债务之中。因此,他们疯狂涨价。还有各级高管严重失职时天马行空的高额赔偿。

“效率”,你说呢?

“何时?”,我追问。

从意识形态上讲,它本来就很蠢,而现在更糟糕。反对公共所有制的论点是认为它“社会主义”。是的,当然。

美国、英国、澳大利亚、加拿大和欧洲是社会主义的象征吗?不,它们不是,也从未是,将来也不会是。在任何时候都不是这样。最后的经济效率低下和管理混乱的USSR被当作社会主义的榜样。现在每个人都在与共产主义中国打交道,这很正常。

不可避免的事实是自私有化和解除管制成为政治精英们偏爱的时候以来,价格不断飙升,贫困也不断加剧。政府实际上已经放弃了监管的权力。

现在我们来到这篇文章的另一个要点。

目前的未来看起来非常愚蠢,因为这些失败的商业模式是唯一的选择。它们还有可能变得更加愚蠢。

现在,私有化和解除管制的十字军已经彻底失败,但他们的征程仍在继续。在欧洲,通常被奉为神圣的金融部门正在推动更多的放松监管。他们穿着古驰麻布衣服和灰烬,想要更多的自由度。或许是为了让他们的政治合唱团更加婉转地演唱,或更加娴熟地翩翩起舞。

...也可能不是。全球金融部门主要依靠虚构和货币上的“自慰”来生存。全球债务已经飙升到315万亿美元。

别胡扯了。

整个行业需要严重重新规制。因为它无法停止印制不存在的货币来产生更多债务。每个人都因此变得更加贫穷。

取消私有化,重新规范,摆脱白痴。这才是你的选择。

#OpEd #私有化 #解除管制 #彻底 #失败 #物价过高 #小丑 #西装

英文版:

Privatised UK water companies have been releasing raw sewage into rivers and along beaches - Copyright AFP Ed JONES

Someone once said, "Let's run government like a business." The wise ones responded, "Duh... OK," and thus the world of mismanagement was created.

The original idea was to run something that isn't, shouldn't be, and can't be a business like one, but by then it was too late. The Western world, in particular, embraced these flawed ideas.

The concept of privatization, which claims to save governments money and reduce bureaucracy, is nonsensical. Privatization is a flawed idea, as evidenced by a simple search of news articles on the topic any day of the week. Significant sources of revenue have been handed over to the private sector, which often evades taxes or pays them reluctantly.

Imagine giving up your job and life savings only to receive a cardboard cutout of Margaret Thatcher or Ronald Reagan as compensation. If you find that satisfactory, there is something seriously wrong with your education and understanding.

To illustrate the impact of privatization, let's consider Australia. It is claimed that Australia saved $100 billion since the 1990s due to privatization, but the actual value of this sum is minor compared to the GDP of over $1.5 trillion per year. Prices have increased significantly over the same period.

Privatization leads to higher prices and the loss of public services that were funded and nurtured over generations. Efficient public services add value and reduce costs. Privatization has resulted in more expensive services and underfunded programs.

Deregulation has led to rampant fraud and corruption, uncontrolled prices, and increased poverty. The corporate world is heavily indebted, driving them to raise prices and compensate executives generously for underperformance.

The argument against public ownership as "socialist" is flawed, as the nations mentioned never truly practiced socialism. Prices and poverty have increased since privatization and deregulation, while governments have relinquished their regulatory powers.

The future appears bleak with failed business models dominating the landscape. The finance sector is pushing for more deregulation, despite the global debt reaching a staggering $315 trillion.

The finance sector must be regulated to prevent further economic instability caused by excessive debt. De-privatization, re-regulation, and removing incompetent individuals are necessary steps to address the current challenges.

Op-Ed: Privatization and deregulation – Two total failures in overpriced clown suits

#OpEd #Privatization #deregulation #total #failures #overpriced #clown #suits

关注流程:打开随信App→搜索新湖畔网随信号:973641 →订阅即可!

公众号:新湖畔网 抖音:新湖畔网

视频号:新湖畔网 快手:新湖畔网

小红书:新湖畔网 随信:新湖畔网

百家号:新湖畔网 B站:新湖畔网

知乎:新湖畔网 微博:新湖畔网

UC头条:新湖畔网 搜狐号:新湖畔网

趣头条:新湖畔网 虎嗅:新湖畔网

腾讯新闻:新湖畔网 网易号:新湖畔网

36氪:新湖畔网 钛媒体:新湖畔网

今日头条:新湖畔网 西瓜视频:新湖畔网